browse

how it works

blog

faqclaim your free consultation

how it works

Our Team

blog

faqclaim your free consultation

Copyright © 2025 Modaro Health. All rights reserved.

Medical debt can feel overwhelming, like an unwelcome guest that shows up after your hospital visit. If your bills have you considering drastic measures, don’t panic. This guide will help you navigate medical debt relief, including bill negotiation and exploring medical tourism.

Facing medical debt? Take a breath. You’re not alone—millions of Americans are dealing with similar issues. Medical debt relief is possible, and there are steps you can take to get back in control.

Never assume your medical bill is accurate. Billing errors are more common than you think. Carefully review each item on your bill, from medications to procedures. If something looks incorrect, contact the billing department. Correcting even a small error can lead to significant savings.

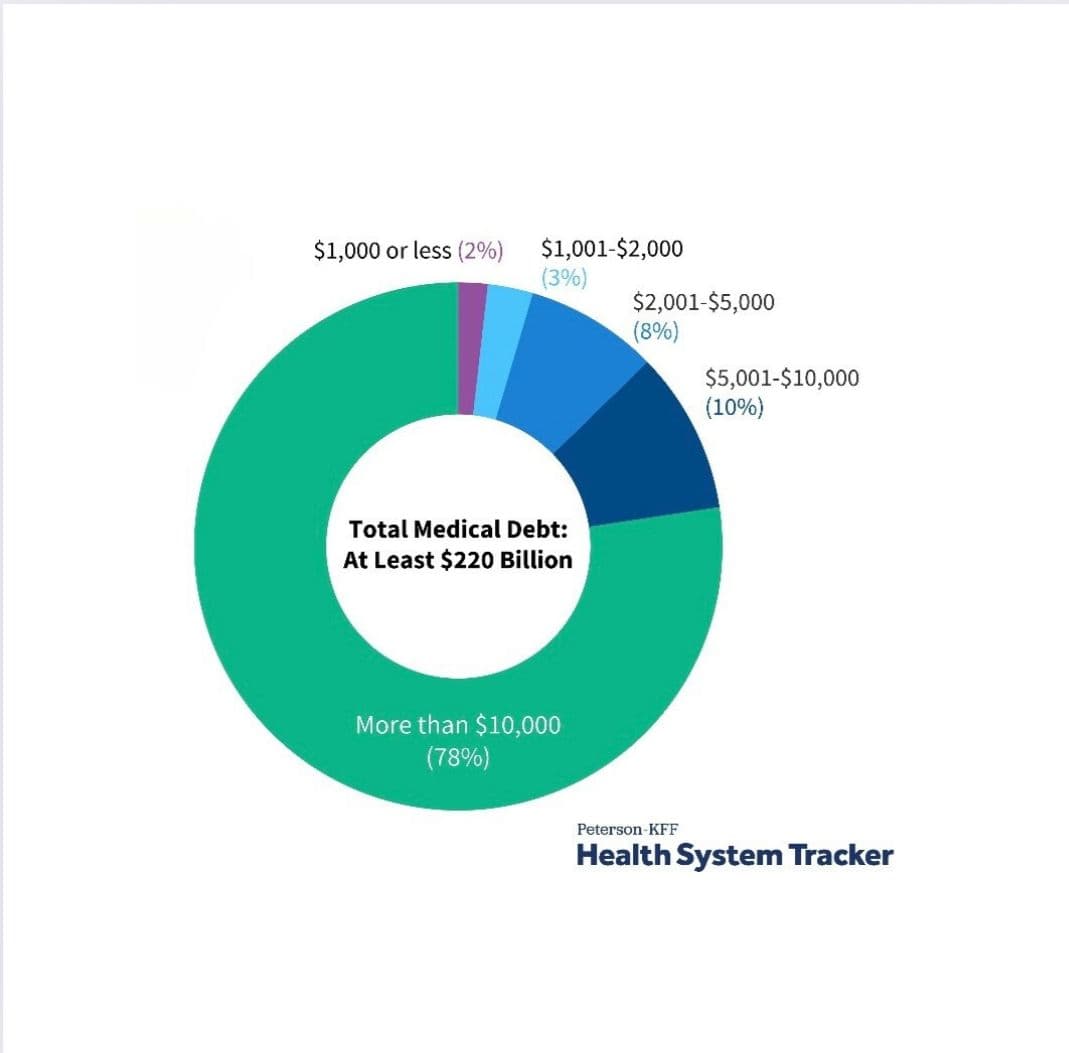

This analysis of government data estimates that people in the United States owe at least $220 billion in medical debt. Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000.

Did you know you can negotiate medical bills? Much like buying a car, healthcare providers often prefer receiving partial payment over nothing at all. Reach out to them before the bill goes to collections and ask about lowering your balance. Negotiating can be a powerful tool for medical debt relief.

Many hospitals and healthcare providers offer payment plans to help you manage your medical debt over time. Instead of a large lump sum, you can make smaller, manageable monthly payments. Be sure to ask about interest rates and any hidden fees before agreeing to a plan.

Hospitals often offer financial assistance programs, especially for low-income patients. You don’t need to feel embarrassed about asking for help—these programs are there to prevent medical debt from becoming insurmountable. Inquire directly with your provider to see if you qualify for medical debt relief.

If you’re considering medical tourism as a way to cut healthcare costs, it’s crucial to research the quality of care abroad. Verify doctor credentials and confirm the hygiene standards of the hospital. Medical tourism can offer significant savings without sacrificing the quality of care—just ensure you are informed.

Explore Modaro Health's medical tourism services for a smooth experience that includes vetted doctors and accredited hospitals.

Ignoring your medical debt will only make things worse. Unpaid medical debt can damage your credit score and lead to more serious financial consequences. Stay proactive by contacting your billing department, setting up payment plans, and communicating regularly to avoid issues.

Why continue dealing with a healthcare system that could bankrupt you? Medical tourism provides high-quality, affordable care at a fraction of U.S. costs. With Modaro Health, you can explore safe, world-class healthcare options abroad while avoiding future medical debt.

Ready to explore affordable healthcare options? Visit Modaro Health for free consultations and world-class care abroad.